|

Heavy discounting in dog-eat-dog market

The raw numbers are not good.

On April 21, Sunday Star-Times publisher Fairfax Media announced 70 job cuts and a further 10 were proposed a week later. Those redundancies were on top of around 160 job cuts announced last September.

Over at TVNZ, 88 jobs are going as a result of a cost-cutting plan announced in March, and magazine publisher ACP Media continues to shed staff – long-serving group publisher Debra Millar left 10 days ago – after restructuring last year slashed its head count by as much as 150.

Newspaper and radio group APN, publisher of the New Zealand Herald, doesn’t release its redundancy numbers but has been pruning staff assiduously for some time – its latest cut reportedly involves 10 staff going from advertising sales.

Small magazine publisher 3Media, whose titles include AdMedia and NZ Management, took the ultimate step this month and placed itself in liquidation – 13 staff have so far lost their jobs.

The media industry is clearly not shirking its contribution to the rising unemployment revealed on Thursday by Statistics NZ. Headline unemployment was 5% in the March quarter, the worst for six years.

In the circumstances, maybe 5% is not bad. Media executives describe the current slump in advertising as the worst they’ve ever seen and even the most optimistic are reluctant to predict a return to growth any time soon.

“I’d be lying to say it’s not as bad as it’s ever been,” said media buyer Derek Lindsay of DraftFCB. Lindsay is not prone to gloom, however, and said this could be as bad as it gets.

“The second quarter is probably going to be the worst quarter of the year, so people’s views are probably exaggerated by the position they’re in now.”

Ad sales this quarter could be down 15% year on year, he said. Overall revenue was probably down 10% for this year.

“It’s led to a very negotiable market,” said Graeme Hunter, of Hunter Media. “The only way for media owners to make targets is to take share from someone else.”

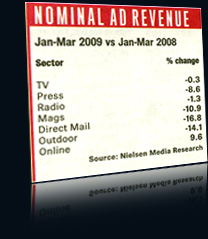

Details of advertising revenue are hard to come by. Figures from Nielsen Media Research indicate modest revenue falls for most media sectors every quarter since April last year, with radio and online being the least affected.

Breaking the numbers down, some advertising sectors appear to be holding up better than others. Real estate and travel apparently remain strong, while financial advertising has plummeted. Automotive fell in 2008 and started the first quarter of this year with a huge drop of 40% on the same period a year ago.

Unfortunately the numbers are unreliable. They are based on official advertising rates and take no account of discounting – as one executive commented, “there is plenty of dealing going on across the media so the true position is no doubt much worse”.

How much discounting goes on is revealed by media company accounts – Nielsen’s figures say TV ad revenue in the 2008 financial year was about $1.3 billion; actual ad revenue from TVNZ, TV Works and Sky for the period was $545 million.

Still, a 10% fall in that number would be $54m – a large sum of money to disappear from media company coffers.

Whether such big drops in revenue have motivated the slashing of jobs is unclear, however. Paul Dzykeul, chief executive of Woman’s Day publisher ACP Media, acknowledged significant head count reductions but said they were down to restructuring.

“None of that is to do with ad revenue,” he said. “Businesses often just traverse along and you contemplate change, but it’s only when a major economic downturn comes along that you say ‘do we really need that position?’ Ad revenue does force the outcome, but you probably should be looking at it anyway.”

APN group publishing chief executive Martin Simons wouldn’t confirm how many jobs had been axed, but said media companies were not exempt from the economic cycle.

“We have reduced costs,” he said. “In the good times, APN has a record of bold investment, exemplified in the launch of the Sunday. When markets are tighter we take prudent measures like any good business.”

Like Fairfax, APN has restructured its production functions so that newspaper and magazine pages are produced centrally rather than at individual titles. This has meant job losses (40 in Fairfax’s case), but is such a complex, time-consuming and risky process it doesn’t resemble a knee-jerk cost cutting response to recession.

Fairfax chief executive Joan Withers said much of the restructuring was normal business activity. “Things like the central sub-editing and the latest pre-press announcement was just the latest iteration of that. But obviously in times like this you have to look at every single cost and say ‘is there something we can take out here?’”

As in other sectors facing job losses, this activity causes concern at the coal face. Employees worry about their security and wonder whether axed staff will be replaced when the market picks up again.

Fairfax group executive editor Paul Thompson said some of the jobs would come back once the market returned to normal, but “that’s really the next phase”.

“It’s not going to happen in 2009. I wouldn’t rule it out next year, but I think it will be very much back to basics in the meantime, and if we are going to grow (jobs) again it will be very measured and very gradual.”

Dzykeul said pockets of advertisers were starting to return. “We’re starting to have conversations with people who are saying ‘enough’s enough’ and want to invest again. It’s a really encouraging sign,” he said.

Nevertheless, “would you be brave enough to say it’s going to start coming away in November, December, January, February? I don’t know. I’m not sure I’m brave enough to say that. My sense is we’re not about to see a major swing back.”

And after an unprecedented slowdown, “I sit here looking at the marketplace and it just amazes me that more [media companies] haven’t fallen over. I know there’s a lot of people hurting out there.”

Given the media sector’s bellwether status for the economy, these comments suggest the recovery may take some time to arrive, and many job cuts so far appear to be long-term.

Meanwhile, executives hold on to the knowledge that despite ugly financial numbers, other indicators remain healthy.

“The good times will return, the recession will come to an end,” said Thompson, “and if media organisations have held on to their audiences, they’ll retain really strong businesses. [According to] the readership figures I’m seeing, the numbers are holding up really well, so that’s a positive sign for the future.”

(Source: Sunday Star Times - May 10, 2009)

|